Bitcoin and Cryptocurrency Trading For Beginners 2024

Cryptocurrencies such as bitcoin and ethereum generate a lot of interest from would-be investors.

But before you jump on the nearest crypto exchange, it is important to understand what you are investing in, the opportunities and the pitfalls.

This beginners’ guide to cryptocurrency aims to give you the information that you need, including:

What is cryptocurrency?

A cryptocurrency is one of many digital currencies that are not linked to any country or government.

Instead, records of who owns what are held on computerised databases secured by strong cryptography using blockchain technology.

While cryptocurrencies can be used to buy day-to-day items in some stores, it is more commonly traded as digital assets for investment profit.

Impressive profits can be made buying and selling on cryptocurrency exchanges. But the prices can be very volatile so you could lose a lot too.

What causes crypto price fluctuations?

Like financial markets, the cryptocurrency market moves up and down very, but how it differs from the stock market in the degree of volatility – it moves very fast.

These fluctuations can be scary but are also the key to how to make money with cryptocurrency. So it’s vital to understand what makes prices move.

Here are some of the main catalysts for price changes:

1. Press coverage: Crypto traders are avid readers of press coverage of their coins. Either positive or negative news can cause them to buy or sell coins, moving the market very quickly.

2. Integration: Cryptocurrencies are becoming increasingly mainstream as a medium of exchange for buying goods.

And as they are accepted by more outlets and are integrated into more banking and payment systems, the prices tend to rise.

3. Wider events: Political events and government decisions relating to cryptocurrencies also move the market.

For example, when China put in more stringent rules on bitcoin “mining” in June, the price of the currency fell dramatically.

We’ve done some analysis whether tougher times are looming for bitcoin in our Is a bitcoin crash coming? article.

What crypto trading strategies are there?

Investors who try to make money trading cryptocurrencies have many different strategies.

Some of the main ones are as follows.

1. Day trading

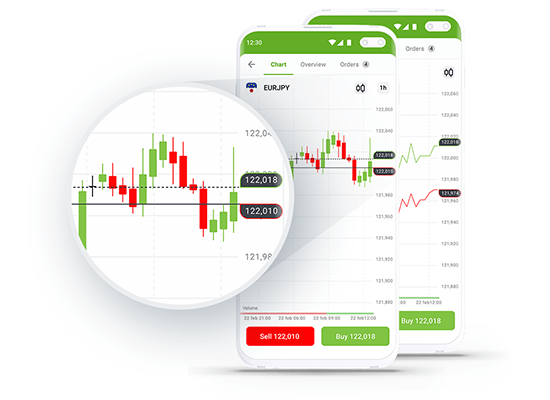

This is a fast-paced form of cryptocurrency trading where people buy and sell cryptocurrencies within a day, to try to take advantage of short-term price movements.

However, this may not be an appropriate way of trading bitcoins for beginners. This is because there is a significant risk of loss when trying to time the market.

2. Hedging

Hedging – where one of your investments cancels out some or all of the risk of losses with another – is a strategy used by some crypto traders who want to hold the coins but not be over-exposed to volatile movements.

You can hedge cryptocurrencies using financial instruments such as contracts for difference or futures. These allow you, in effect, to bet on the future price of the currencies.

This is a tricky strategy that should only be used if you understand exactly what you are doing.

3. HODLing

Those who “hodl” a cryptocurrency keep hold of it through thick and thin.

If it sounds like a typo, that’s because it originally was – the term originates from a typing mistake on an early bitcoin forum. But it is often retrospectively explained as standing for Holding on for Dear Life.

4. Trend trading

Trend trading is where crypto investors decide to buy or sell particular currencies based on whether their price is moving up or down.

There are many more complex theories on how to identify a trend, or when it is going to change. But the basic theory is that these cryptocurrency traders buy in a market that is going to rise and sell when it is going to fall.

The difficulty comes in identifying which is which.

Whichever strategy you employ, it is important to be aware of the large number of cryptocurrency scams that exist on the internet and elsewhere.

The Financial Conduct Authority, which regulates UK investments, recently warned on the high number of crypto scams and gave suggestions on how to avoid them.

Which crypto should I invest in?

Bitcoin, ether and dogecoin are some of the most famous cryptocurrencies. But there are now thousands to choose from.

Choosing the right cryptocurrency for you will involve a number of factors. Fundamental analysis determines the intrinsic value of an asset, which is harder to do with crypto. You also need to factor in risk management.

You may be concerned about the environmental impact of some currencies, whose creation requires a lot of computing power. If so, you may prefer an eco version.

Or you may be interested in using a specific coin exchange or broker that deals with only a limited number of currencies, so will have limited choice. This avoids the confusion that comes with too much choice.

Some people may be attracted to the newcomer worldcoin, which is believed to be founded on the altruistic idea of fairer wealth distribution, and is supported by some large Silicon Valley names.

Safemoon, a new currency that is meant to discourage day traders by placing a penalty on those who sell the currency, is a possibility for dedicated HODlers.

For full lowdown on what you can invest in, go to Bitcoin alternatives – the most important other cryptocurrencies.

What are the risks of cryptocurrency?

Those who trade cryptocurrency should be aware of the risks. As mentioned above, crypto is volatile and the price can fall fast. Other dangers include the potential for losing all of your money to a fraudster.

Losing your password to the digital wallet where you hold your cryptocurrency – or the hard drive where you have stored your precious coins – is also a risk.

Whichever way you choose to invest in cryptocurrency, doing your homework first should minimise the mistakes and enhance your possible profits. Our The most common crypto mistakes article has the full lowdown.

What are the best cryptocurrency books to read?

There are so many cryptocurrency books and blogs that it can be hard to distinguish the best bitcoin guides, for example.

If you are looking for information on cryptocurrency investing for beginners, or a crypto blog that explains new launches, below are some of the best places to look.

For crypto blogs, try this list from Detailed.com, which looks into many of the best blogs for both beginners and experts.